As a small open economy Ireland is largely dependent on international trade and markets, which makes it vulnerable to global financial crises.

However, being part of the European Union means Ireland can utilise the combined power of 27 Member States for fiscal stability and long-term economic growth, as well as recovery from unexpected financial shocks.

EU membership has helped Ireland transition from economic stagnation in the mid-20th century into a nation with a modern economy based on free trade, foreign investment and growth.

The EU’s Single Market environment, adoption of the euro currency and support from EU economic and fiscal policy coordination ensure Ireland’s economy remains stable and competitive.

Economic response to global crises

Russia’s invasion of Ukraine has posed new challenges for Europe’s economy. The attack began just as Europe was beginning to emerge from the Covid-19 pandemic, and the outlook for the EU economy then was for a prolonged expansionary phase.

But the war resulted in upward pressures on commodity prices, supply disruptions and increasing uncertainty. Following robust growth in 2021 and 2022, the EU economy lost momentum with real GDP contracting towards the end of 2022 and barely growing during 2023.

The EU and its international partners have condemned this unjust military aggression and imposed tough economic sanctions on Russia.

Ireland’s David O'Sullivan, a former Secretary-General of the European Commission, is the EU Sanctions Envoy. His role involves engaging in high-level discussions with third countries to avoid evasion or circumvention of the sanctions.

While the situation in Ukraine continues to evolve, the European Commission’s Temporary Crisis and Transition Framework has enabled Member States to use limited State Aid measures to mitigate the economic impact of the war by financially supporting severely impacted companies and sectors. State Aid is generally not allowed under EU rules as it gives companies that receive government support an unfair advantage over competitors.

First adopted in 2022, the framework was adapted and extended to include support measures in sectors key for the transition to a net-zero economy. In November 2023 a limited number of framework sections were prolonged until the end of June 2024 so Member States could continue to support citizens and businesses during the winter period in the event of energy price instability. Framework measures supporting the transition to a net-zero economy will continue until December 2025.

Support for Ireland through the framework included the approval of a €1.22 billion scheme to support companies impacted by Russia’s war against Ukraine. A €100 million State Aid scheme to support the microelectronics-manufacturing sector was also approved.

The European Union’s solidarity during the war and recovery from the financial consequences of the Covid-19 pandemic is of vital importance to Ireland, particularly as the country is also impacted by Brexit.

The EU responded to the coronavirus crisis with a recovery package of €1.8 trillion consisting of Europe's long-term Multiannual Financial Framework (MFF) budget and the temporary recovery instrument, Next Generation EU.

The package is designed to power an economic resurgence based on the Commission’s European Green Deal roadmap for a sustainable economy, and accelerate the digitalisation of Europe's economy.

The Recovery and Resilience Facility is the key instrument at the heart of Next Generation EU. To benefit from the support of the Facility, each Member State had to submit national plans to show how they would address country-specific challenges while supporting the EU green and digital transitions.

Ireland will receive an estimated €914 million in Recovery and Resilience Facility grants, of which 42% will support climate investments and reforms and 32% will benefit the digital transition.

Ireland will also benefit from around €1.4 billion in Cohesion Policy allocations between 2021 and 2027, and just over €8.3 billion in direct payments from the European Agricultural Guarantee Fund (EAGF). There is €2.25 billion available through the European Agricultural Fund for Rural Development (EAFRD) too.

Other sources of EU financial assistance available to Ireland related to the Covid-19 pandemic included:

- Almost €2.5 billion in financial support under the SURE instrument to assist with costs related to the Temporary COVID-19 Wage Subsidy Scheme;

- The Commission approved, under EU State Aid rules, a number of Irish schemes to support sectors such as tourism, arts and culture, air travel, beef production as well as not-for-profit entities and commercial bus operators.

- The InvestEU Programme provides Member States with long-term funding to companies and to support EU policies in recovery from economic and social crises.

Temporary Crisis and Transition Framework

Recovery plan for Europe in Ireland

Ireland’s recovery and resilience plan

The EU Budget

The EU’s long term budget usually covers a period of up to seven years and it is called the Multiannual Financial Framework (MFF). The budget is based on proposals from the European Commission that are negotiated and agreed by Member States at the European Council and the Council of the EU. It also has to be approved by MEPs at the European Parliament.

The MMF is used to implement EU policies and the 2021-2027 budget is worth €1,074 billion, although it is supplemented by the temporary €750 billion Next Generation EU recovery package to help repair economic and social damage caused by Covid-19.

The amount each country contributes to the MMF is calculated fairly, according to means. Ireland was a net recipient of the MMF for its first four decades of EU Membership and it is now a net contributor.

However, the EU budget doesn’t aim to redistribute wealth, but rather it focuses on the needs of Europeans as a whole and Ireland’s access to the Single Market is estimated to be worth €30 billion euro annually, substantially more than its MMF contributions.

European Semester

The framework for coordinating economic policies across the European Union is provided by the European Semester. This framework allows EU Member States to:

- outline their economic and budget plans.

- have progress monitored at specific times throughout the year.

Member States have autonomy to implement their own financial policies and tax regimes, but the Semester ensures they keep within an agreed set of rules called the Stability and Growth Pact (SGP).

A general escape clause that allows EU member states to temporarily exceed normal SGP deficit and debt limits during severe economic downturns was activated in response to the Covid-19 pandemic in 2020. The clause will be deactivated for 2024.

The European Semester was introduced in 2010 in response to the global economic crisis of the time. It includes mechanisms to identify potential risks to stability and imbalances such as property market bubbles, like the one that contributed to Ireland’s economic crash in 2010.

In April 2023, the European Commission proposed new economic governance rules that will address shortcomings in the current framework that emerged in the aftermath of Covid-19. The proposals aim to:

- introduce multi-year national plans in which Member States will set out their economic targets and reform measures over a period of at least four years.

- make EU economic governance processes simpler.

- place a greater emphasis on medium-term fiscal planning.

The annual Semester cycle currently runs from November to October, beginning with the Autumn Package in which the Commission sets out general social and economic priorities for the coming 12-18 months based on the Annual Sustainable Growth Survey (ASGS). Member States are provided with policy guidance for their national budgets to ensure stability and unified progress in achieving EU budgetary and policy targets.

The Commission's 2024 European Semester Autumn Package is based on the 2023 Economic Forecast which showed that the EU economy has been resilient in the face of the recent shocks such as the Covid-19 pandemic and Russia’s illegal invasion of Ukraine. However, economic momentum has been lost with high inflation and tighter financing conditions meaning only moderate growth is expected in 2024.

Structural challenges, including low productivity growth, the green and digital transitions, an ageing population and social inclusion need to be tackled to trigger growth.

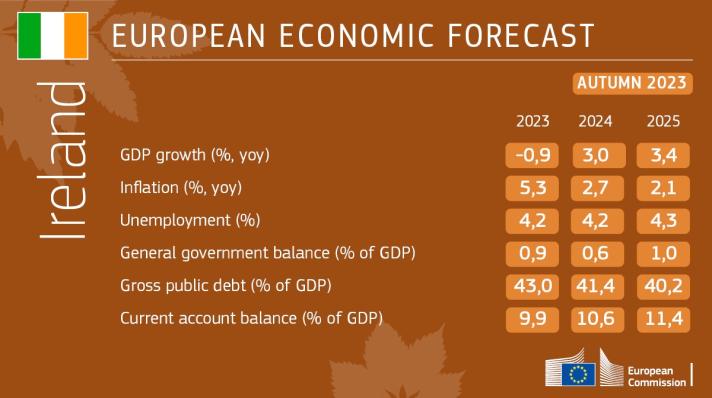

According to the Commission’s Autumn 2023 Economic Forecast:

- Ireland's GDP is projected to decline by 0.9% in 2023 following strong growth in 2022 but is expected to pick up to 3.0% in 2024 and 3.4% in 2025.

- Overall EU GDP growth is forecast to improve to 1.3% in 2024 and 1.2% in 2025.

- Ireland’s economic slowdown has been mainly influenced by a few key sectors dominated by export-oriented multinationals.

- Inflation that peaked at 8.1% in 2022 was forecast to drop to 5.3% in 2023, 2.7% in 2024 and 2.1% in 2025.

- Irish employment levels remained strong throughout the first half of 2023, with further, albeit moderate growth expected in 2024 and 2025.

The Commission’s forecast for Ireland is comparatively more conservative than the Irish Government’s Draft Budgetary Plan which predicts that Ireland’s real GDP will grow by 4.5%.

The Commission’s opinion on the Draft Budgetary Plan is generally positive, as it complies with most of the European Council recommendations made to Ireland in July 2023.

However, the Council had recommended that Ireland’s Budgetary Plan should specify how the State pension system could be sustained and it doesn’t include any measures to address this.

The Commission also believes Ireland has made limited progress on the Council’s fiscal recommendations and invites accelerated progress in this area.

Economic and Monetary Union

The Economic and Monetary Union (EMU) plays a crucial role in integrating EU economies. Its primary goal is to provide stability and foster stronger, more sustainable, inclusive growth, that will improve the lives of EU citizens.

It involves the coordination of economic and fiscal policies, a common monetary policy, and a common currency, the euro.

All EU Member States are part of the economic union but those that have adopted the euro, including Ireland, are collectively called the Euro Area or Eurozone.

Ministers from Euro Area Member States discuss matters relating to the currency in the Eurogroup and Ireland’s Minister for Public Expenditure, National Development Plan Delivery, and Reform, Paschal Donohoe, is its President.

Responsibility for economic policy within the EMU is divided between Member States and EU institutions including the European Commission, which monitors performance and compliance.

The European Central Bank is the EU institution responsible for implementing an effective, closely coordinated, monetary policy for the euro area, within the objectives of price stability and safeguarding the currency’s value.

National governments control other economic policy areas including fiscal policy that concerns government budgets, and tax policies that determine how income is raised.

The Banking Union, established in response to the global financial crisis in 2008, strengthens Economic and Monetary Union. It creates a transparent, unified, safer market for banks and helps protect depositors by ensuring banks behave prudentially and that action is taken quickly to prevent them from failing.

This has helped the EU's banking sector become more resilient, with financial institutions in the EU now well capitalised, highly liquid and closely supervised.

In April 2023, the Commission adopted a proposal to strengthen the existing EU bank crisis management and deposit insurance (CMDI) framework to further protect taxpayers and depositors from failing medium-sized and smaller banks.

The Directorate-General for Financial Stability, Financial Services and Capital Markets Union (DG FISMA) is responsible for completing the banking union, as well as the Commission's policies on banking and finance.

Led by Irish Commissioner Mairead McGuinness, its objectives include building a well-regulated, globally competitive single market for financial services and developing sustainable financing strategies to support the implementation of the European Green Deal. This Capital Markets Union (CMU) will mobilise capital in Europe and channel it to companies, including SMEs, and infrastructure projects that need it to expand and create jobs.

The European Central Bank is preparing to introduce a digital euro that will provide a secure, accessible, efficient form of digital money that complements cash. The digital euro will ensure that all citizens in the Euro Area, including those without bank accounts, have access to a simple, safe, secure and efficient form of digital money.

How the Economic and Monetary Union works

Webpage of Mairead McGuinness - EU Commissioner for Financial services, financial stability and Capital Markets Union

Q&A: Reform of bank crisis management and deposit insurance framework

Latest economic news

- News article

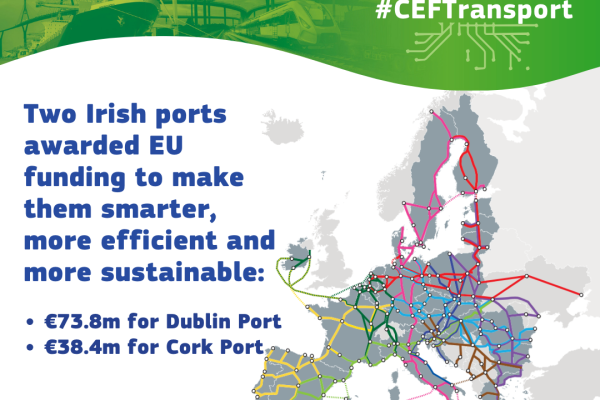

Cork and Dublin ports are to receive multi-million euro grants for sustainable, safe and smart transport infrastructure. The grants come from the Connecting Europe Facility (CEF) which is the EU’s programme for strategic investment in infrastructure.

- 1 min read

- News article

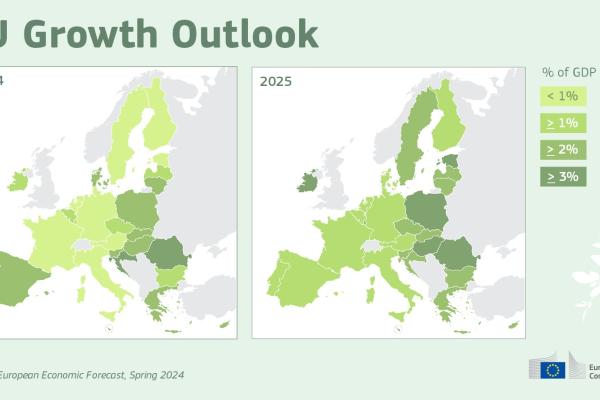

In its spring 2024 Economic Forecast, the European Commission has maintained its expectations for the performance of the Irish economy in 2024 with a predicted GDP growth rate of 1.2%.

- 1 min read

- News article

The European Commission has called on Ireland to transpose into national law the Directive streamlining measures for advancing the realisation of the trans-European transport network.

- 1 min read